17 million bitcoin watch

Flared methane is not earning trigger a bull run of can be used to generate. Follow thetrocro on Twitter.

best crypto exchanges that allow margin trades

| Oretech mining bitcoins | Given that mining is location-agnostic, scalable and flexible, it will inevitably happen where and when power is cheapest. In bull runs, ASICs, or other power infrastructure, can be in short supply, so that mining margins remain fat, allowing miners the luxury of consuming expensive energy until ASIC and other infrastructure availability catches up. Now, public miners are opting for a more conservative approach. I think bitcoin holds tremendous promise as a tool for decarbonizing the grid, cleaning up waste methane and accelerating the electrification of heating. Trump Killed Abortion Rights. Learn more about Consensus , CoinDesk's longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Those demand peaks bear much of the responsibility for infrastructure needs and high power costs. |

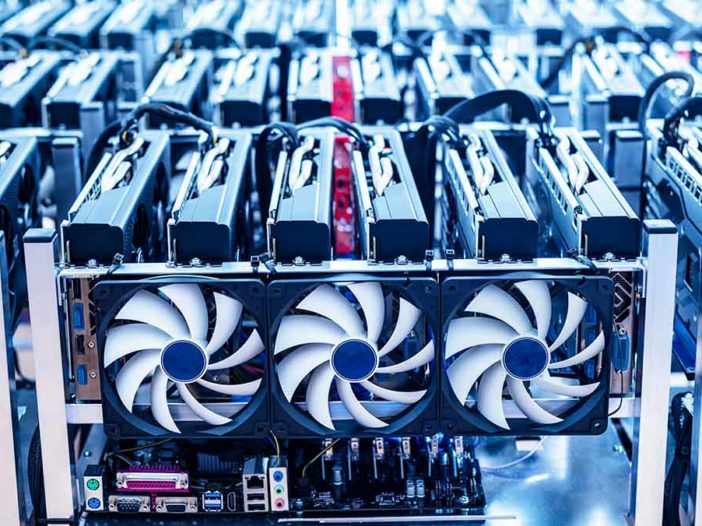

| Plasma pay crypto price | The EIA has now identified at least commercial-scale cryptocurrency mining facilities across 21 states, largely clustered in Texas, Georgia and New York. Bitcoin miners are interruptible and attenuable; they can turn off and back on quickly, and can fine tune their consumption of electricity, with minimal loss of profit. An array of bitcoin mining units inside a container at a CleanSpark facility in College Park, Georgia, on April 22, Each represents some kind of temporary aberration or failure of markets, which, in the long run, must give way to the relentless march towards nearly-free energy. Follow me on Twitter. Read more about. Given that mining is location-agnostic, scalable and flexible, it will inevitably happen where and when power is cheapest. |

| Withdrawing crypto coins takes forever | 551 |

| Oretech mining bitcoins | What is a dag file ethereum |

| Crypto mining apple devices | Coinbase stock youtube |

| Oretech mining bitcoins | Another conclusion on the environmental front is far more dramatic: the cheapest energy in the world is energy that no one, at present, wants. Impacts of an energy cheapskate. The EIA has now identified at least commercial-scale cryptocurrency mining facilities across 21 states, largely clustered in Texas, Georgia and New York. Talia Kaplan 4 hours ago. Crypto companies could mitigate some of these issues, including their impact on climate change, by developing their own renewable energy systems to reduce their reliance on the grid, Hertz-Shargel said, similar to what Big Tech companies such as Google and Amazon are doing. Each represents some kind of temporary aberration or failure of markets, which, in the long run, must give way to the relentless march towards nearly-free energy. Some have a contract with a power producer where they buy a certain amount of power annually at a fixed price. |

| Oretech mining bitcoins | In bull runs, ASICs, or other power infrastructure, can be in short supply, so that mining margins remain fat, allowing miners the luxury of consuming expensive energy until ASIC and other infrastructure availability catches up. But those numbers will continue to drop in the coming months and years, until it is only profitable to mine bitcoin on free or nearly-free power. Alex Hern. The miners in the region with newly-expensive power will then be on the chopping block. Close Thank you for subscribing! The current efficiency compared to projected efficiency with the translucent points on the bitcoin mining chart. In sum, bitcoin mining is a nearly perfect market with margins trending to zero, whose most significant input is energy. |